Kathleen Murphy’s Tax Problems

- Five times between 2005 and 2012, she failed to properly pay her property taxes in Fairfax County.

- In 2010 and 2011, she failed to properly pay her property taxes for her Staten Island home.

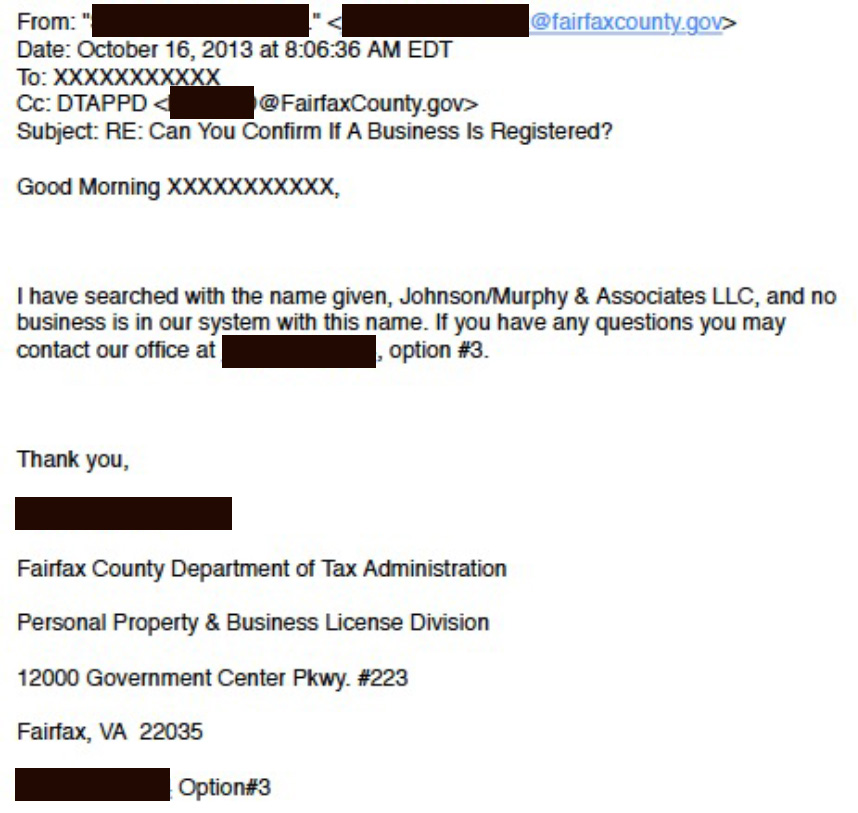

- Although she claims enough revenue for Johnson Murphy & Associates to be required to pay Fairfax County fees, it is believed that her company has not been registered in Fairfax County.

- Murphy claims revenue from Weskas, LLC for a rental property she owns. Weskas is a Colorado corporation in poor standing (delinquent) since 2011 for failing to file periodic reports.

Kathleen Murphy Habitually Failed To Pay Property Taxes On Time For Her McLean Home:

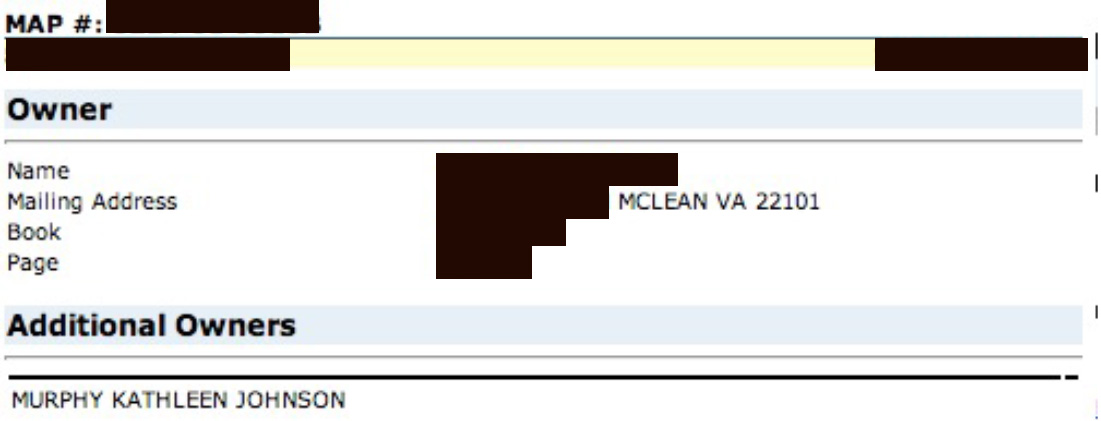

███████████ And Kathleen Johnson Murphy Are The Listed Owners Of ███████████, Mclean, VA. (Fairfax County Property Search, http://icare.fairfaxcounty.gov/, Accessed 7/25/13)

According To Fairfax County Tax Records, Property Taxes For ███████████ Have Been Paid Late Five Times.

- In 2012, ███████████ Was Assessed $802.52 For Unpaid Property Taxes. (Fairfax County Property Database, Document Attached)

- In 2008, ███████████ Was Assessed $734.39 For Unpaid Property Taxes. (Fairfax County Property Database, Document Attached)

- In 2006, ███████████ Was Assessed $723.01 For Unpaid Property Taxes. (Fairfax County Property Database, Document Attached)

- In 2005, ███████████ Was Assessed $699.96 For Unpaid Property Taxes. (Fairfax County Property Database, Document Attached)

- In 2005, ███████████ Was Assessed $705.72 For Unpaid Property Taxes. (Fairfax County Property Database, Document Attached)

Kathleen Murphy Twice Failed To Pay Property Taxes On Time For Her New York City Home:

Kathleen J. Murphy Is The Listed Owner Of ███████████, Staten Island, NY. (NYC Finance Department, Property Tax Bill, http://nycprop.nyc.gov/, 2/18/11)

On February 18, 2011, The NYC Finance Department Notified Murphy Of A $31.93 Unpaid Property Tax Balance. (NYC Finance Department, Property Tax Bill, http://nycprop.nyc.gov/, 2/18/11)

On November 19, 2010, The NYC Finance Department Notified Murphy Of A $1,392.67 Unpaid Property Tax Balance. (NYC Finance Department, Property Tax Bill, http://nycprop.nyc.gov/, 11/19/10)

There Are No Records Available That Show Kathleen Murphy Having Registered Or Paid Taxes In Fairfax County For Her Business:

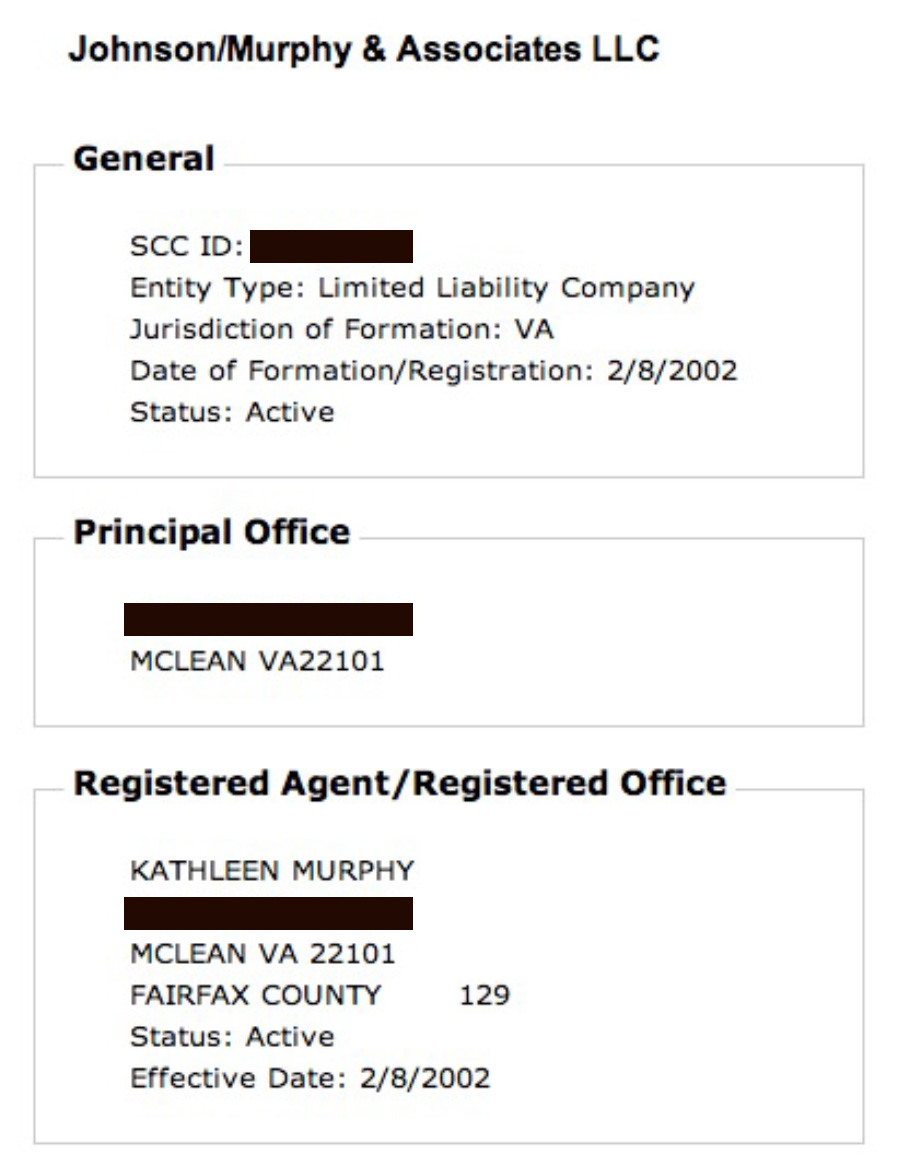

Kathleen Murphy Owns The Company Johnson/Murphy & Associations LLC, A Virginia Corporation In Good Standing, And Registered At ███████████. (Virginia Secretary of State, https://sccefile.scc.virginia.gov/, Accessed 7/25/13)

Murphy Has Highlighted Her Business As A Qualification For Office. “Democrat Kathleen Murphy is President of Johnson Murphy & Associates, a consulting firm based in McLean that provides strategic counseling and builds legislative strategies for companies and non-profit organizations.” (Kathleen Murphy For Delegate, http://kathleenmurphyfordelegate.com/about/, Accessed 7/25/13)

According To Kathleen Murphy’s Financial Disclosure, She Has Received Income Between $10,000 And $50,000 From Johnson Murphy & Associates. (Kathleen Murphy Statement Of Economic Interest, Virginia Public Access Project, http://www.vpap.org/, Accessed 7/25/13)

Fairfax County Requires Businesses To Register And Pay A Fee If The Company’s Revenue Exceeds $10,000. (Business Tax FAQs, Fairfax County, http://www.fairfaxcounty.gov/, Accessed 7/25/13)

According To A Clerk At The Fairfax County Tax Administration Office, Johnson/Murphy & Associates Is Not Registered In Fairfax County:

Murphy’s Colorado Company Is Delinquent For Repeated Failures To File Periodic Reports:

Kathleen Murphy Reported Income Under $50,000 From A Rental Property Owned By Her Colorado Corporation, Weskas LLC. (Kathleen Murphy Statement Of Economic Interest, Virginia Public Access Project, http://www.vpap.org/, Accessed 7/29/13)

Kathleen Murphy Is The Founder And Owner Of Weskas, LLC. (Colorado Secretary Of State, http://www.sos.state.co.us/, Accessed 7/29/13)

Weskas, LLC IS Currently Delinquent Corporation In Colorado. (Colorado Secretary Of State, http://www.sos.state.co.us/, Accessed 7/29/13)

Weskas, LLC Was Repeatedly Cited By The Colorado Secretary Of State For Failure To File Periodic Reports. (Colorado Secretary Of State, http://www.sos.state.co.us/, Accessed 7/29/13)